Partner at AKD Lawyers

Practice Areas: Personal Injury, Insurance Claims

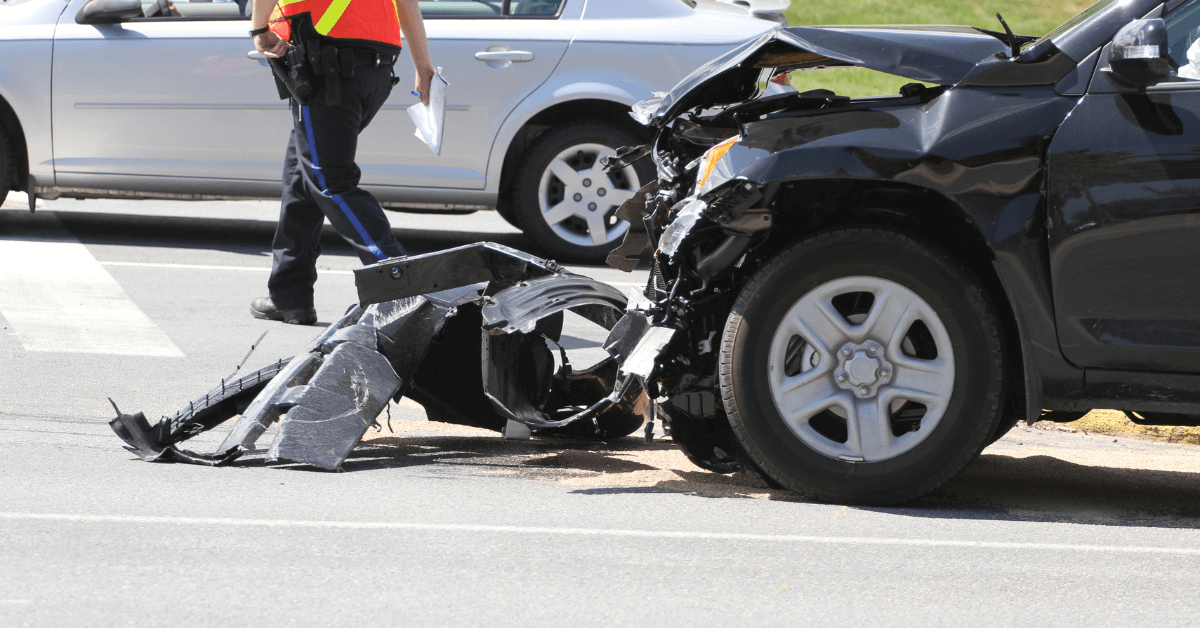

Car accidents in Louisiana can be stressful and confusing, especially when you are unsure of what to do or how the laws apply to your situation. From insurance requirements to fault rules and strict deadlines, understanding how Louisiana handles car accidents can make a major difference in protecting your rights and getting fair compensation.

This detailed guide explains everything you need to know about Louisiana car accident laws, reporting rules, and insurance requirements in simple terms. Whether you’re learning as a cautious driver or dealing with the aftermath of a crash, this article will help you stay informed.

Understanding Louisiana’s Car Accident Landscape

Louisiana’s car accident laws are unique in many ways. Unlike some states that follow a “no-fault” insurance system, Louisiana is a fault-based state, meaning the person who caused the accident is responsible for paying damages.

Knowing your responsibilities after a crash can help you avoid penalties, protect your claim, and make informed decisions about insurance or legal action. Each step after an accident from moving your vehicle to documenting the scene plays a vital role in how your claim is resolved.

Reporting a Car Accident in Louisiana

If you’re involved in an accident that causes injury, death, or property damage over $500, Louisiana law requires that you report it to the police immediately. The responding officer’s report becomes an essential part of your insurance claim and can support your version of events.

“Under Louisiana law (La. R.S. 32:398), drivers must report any car accident resulting in injury, death, or property damage over $500.”

A police report includes important information such as witness statements, road conditions, and who was cited at the scene. Failing to report an accident can lead to fines and insurance complications.

Always ask for a copy of the report once it’s available, and check that all details are accurate.

Documenting and Preserving Evidence

Accurate documentation can be one of your strongest tools after a car accident. Take clear photos of vehicle damage, skid marks, road signs, and any visible injuries. Record the time, weather, and location. Write down everything you remember while it’s still fresh in your mind.

“Proper documentation can strengthen your case by providing clear evidence of how the accident occurred.”

Keep all medical bills, repair receipts, and communication from insurance companies. These records help prove the financial and physical impact of the accident if a dispute arises later.

Comparative Negligence and Fault in Louisiana

Louisiana follows a pure comparative negligence rule under Civil Code Article 2323. This means that even if you were partly at fault, you can still recover damages, but your compensation will be reduced based on your share of fault.

“Louisiana follows a pure comparative negligence system even if you’re partly at fault, you can still recover damages, reduced by your percentage of fault.”

For example, if you were 30% responsible for a crash and your damages totaled $50,000, you would still be entitled to recover $35,000. Insurance companies often use this rule to argue for lower settlements, so understanding how fault works can help you avoid unfair outcomes.

The “No Pay, No Play” Law

Louisiana’s “No Pay, No Play” law is designed to penalize uninsured drivers. According to La. R.S. 32:866, uninsured motorists are barred from collecting the first $15,000 of bodily injury damages and the first $25,000 of property damage, even if they weren’t at fault.

There are exceptions to this rule. For example, if the at-fault driver was intoxicated or intentionally caused the crash, the law may not apply. To avoid losing out on compensation, always maintain at least the minimum required auto insurance coverage in Louisiana.

Insurance Requirements and Coverage

Louisiana requires all drivers to carry liability insurance with minimum coverage amounts of:

- $15,000 for bodily injury per person

- $30,000 for bodily injury per accident

- $25,000 for property damage

Drivers are also encouraged to carry uninsured and underinsured motorist coverage (UM/UIM). This protects you if the at-fault driver doesn’t have enough insurance to cover your losses.

Keeping adequate coverage ensures you’re not left with unexpected costs after a crash. Understanding how your insurance works and reviewing your policy before an accident happens can save time and frustration later.

Statute of Limitations and Direct Action Rights

Louisiana has one of the shortest time limits in the country for filing a car accident lawsuit. You have one year from the date of the accident to file a personal injury or property damage claim under Civil Code Article 3492.

“You have only one year from the date of the accident to file a car accident claim in Louisiana, one of the shortest statutes of limitation in the U.S.”

Louisiana also has a Direct Action Statute (La. R.S. 22:1269) that allows you to file a claim directly against the insurance company rather than the at-fault driver. This can make the process faster and more straightforward, especially in serious accidents.

No Damage Caps in Louisiana

Unlike some states that limit how much compensation accident victims can recover, Louisiana generally does not cap damages in car accident cases, except in small claims court. This allows injured individuals to seek full recovery for medical costs, lost wages, and pain and suffering.

Keeping detailed medical and financial records helps demonstrate the full impact of an accident and strengthens your claim for fair compensation.

Key Legal Requirements in Louisiana Car Accident Cases

|

Aspect |

Legal Requirement / Explanation |

| Reporting | Required if injuries, death, or property damage exceed $500 |

| Fault System | Pure Comparative Negligence (La. Civ. Code Art. 2323) |

| Insurance Requirement | Minimum liability + optional UM/UIM |

| “No Pay, No Play” Law | Limits recovery for uninsured drivers (La. R.S. 32:866) |

| Statute of Limitations | 1 year from the date of accident (La. Civ. Code Art. 3492) |

| Direct Action Statute | Victims can sue insurers directly (La. R.S. 22:1269) |

Frequently Asked Questions

Is Louisiana a no-fault or fault-based state?

Louisiana is a fault-based state where the at-fault driver’s insurance covers damages.

What happens if I don’t report a car accident in Louisiana?

Failure to report can result in penalties and make your insurance claim harder to prove.

Can I recover damages if I’m partially at fault?

Yes. Compensation is reduced by your percentage of fault under Louisiana’s comparative negligence rule.

What is the “No Pay, No Play” law?

It restricts uninsured drivers from recovering specific amounts even if they weren’t responsible for the crash.

How long do I have to file a car accident claim?

You have one year from the date of the accident to file your claim.

Conclusion

Louisiana’s car accident laws can be complex, but understanding them can protect your rights and financial future. Knowing how to report an accident, document evidence, and follow the state’s unique laws can prevent costly mistakes.

If you’ve been in a car accident and need clarity on your next steps, the team at Alvendia, Kelly & Demarest Law Firm in New Orleans is here to help. Their attorneys understand Louisiana’s insurance and liability rules and can guide you through the process.

Contact Alvendia, Kelly & Demarest for a free consultation to discuss your situation and learn how Louisiana law applies to your case.

Categories

In 2003, after being dissatisfied with the quality of legal care for victims of car accidents, Roderick ‘Rico’ Alvendia sought to establish a new firm focused on providing high-quality legal services to aid injured victims and their families. J. Bart Kelly, sharing Rico’s passion for upholding justice, joined the firm later that year, and established a partnership.